Case Studies

Improving

credit scoring

for existing customers

20% higher revenues

for a credit cards issuer

A large credit card issuer with over 3.5M customers wanted to increase credit score accuracy.

The initial pilot enabled the customer to add external data to 60% of its customers, which significantly increased the model accuracy (an over 50% increase in the Gini coefficient index).

The full implementation of the EyeOnRisk platform took a single day. It currently delivers a monthly report of the updated credit score for all customers.

Results

EyeOnRisk was a game changer for the credit card issuer, with a double-digit impact on default rates and overall revenue.

13.2%

Decrease in default rates

20%

Overall increase in revenues

Improving application screening

for new customers

A retail lender sees >18% reduction in defaults

A retail lender wanted to upgrade his new customer application process. The lender used the EyeOnRisk platform to build a model that integrated external data about the customer with the application’s data. The integration across internal and external systems was seamless, and the lender’s ability to accurately estimate the customers’ risk profile improved significantly.

Project Results

The EyeOnRisk platform enabled the creation of a much more accurate model, which led to a double-digit reduction in defaults.

34%

Improvement in model (Gini)

18.75%

Reduction in defaults

Improving business results and increasing explain-ability for a retail bank

19% reduced default rates

Models built over EyeOnRisk outperformed the bank’s legacy model across OOT & achieved great swap sets results:

Keeping the same risk profile, achieve reduced default by 19.4% with 2.2% higher net accepted

Or

Same default, with higher net accepted by 15.1%

A shorter platform update cycle meant the bank’s models were using the latest data and yielding better results vs. legacy models

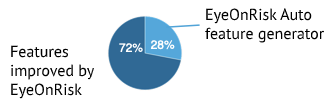

The platform’s feature recommendation capability generated the most influential model features